CANADIAN DOLLAR OUTLOOK FIRMS ON EASING TRADE TENSION AND WITH GDP AHEAD

Fundamental Forecast for CAD: Bullish

USDCAD Analysis and Talking Points:

- NAFTA Concerns Eased After Juncker/Trump Statement

- Robust Canadian GDP May Provide Boost for Loonie

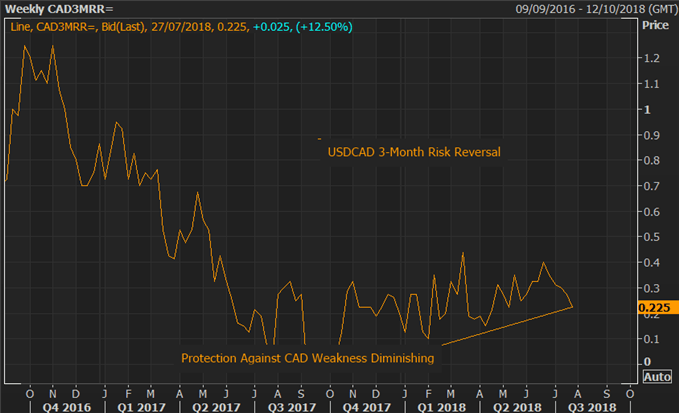

- Risk Reversals Suggest Diminished Demand for CAD Weakness

NAFTA Concerns Eased After Juncker/Trump Statement

Sentiment surrounding the Canadian Dollar has been somewhat positive following the de-escalated trade tensions between the US and EU. This came after both parties made progress in agreeing to have a truce on tariffs, pending more talks to resolves trade barriers at issue. Consequently, the spill-over effects have eased NAFTA concerns, additionally, recent headlines regarding NAFTA have been positive with US Trade representative stating that it is possible for NAFTA partners to reach an agreement in principle next month.

Canadian GDP May Boost Loonie

On the data front, the key risk will be the GDP report for May. There is a potential for a robust figure around the 0.4%, which will likely buoy the Loonie. Domestic activity has been strong across the board, including a 2% rise in retail volumes and 1.3% increase in wholesales volume. Downside risks are from the manufacturing metric due to the continued shutdown in refineries, which had weighed on manufacturing sales. However, with this in mind there is a potential for an annualised reading of 2.6%, close to the BoC’s 2.8% projection in the July MPR.

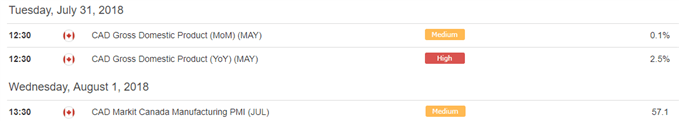

Next week’s Economic Calendar

Source: DailyFX

Canadian Dollar Bulls Gaining Momentum

BoC rate hike expectations are firmer with over 15bps priced in for the October meeting, while a 25bps rate hike is almost fully priced in by the year-end. In option markets, CAD put premiums have shown a material decline, signalling that demand for further CAD weakness has diminished. Alongside this, US-Canadian 2yr bond spreads have tightened and is now looking at the key 60bps mark, consequently keeping USDCAD pressured, while sizeable short interest in CAD are vulnerable to a potential squeeze.

USDCAD PRICE CHART: DAILY TIMEFRAME (October 2017-July 2018)

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IT IS POSSIBLE TO SHIFT FROM $30 TO $1,000,000 TRY TODAY

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

SUPPORT , CLICK SMS BAR ABOVE THEN TALK TO US.

Comments

Post a Comment