WHEN ARE THE EUROZONE FLASH CPIS AND HOW COULD THEY AFFECT EUR/USD?

Eurozone flash CPIs estimate overview

Eurostat will publish the Eurozone's inflation first estimate for August at 09.00 GMT today. Consumer prices are expected to stagnate at 2.1% on a yearly basis while the core figures are also seen flat at 1.1% in the reported month.

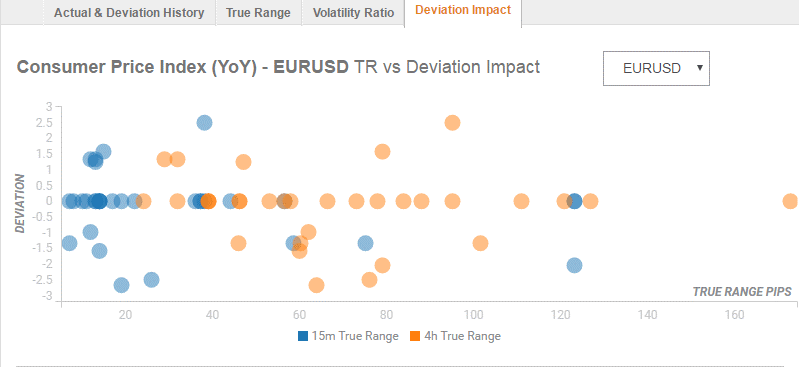

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

According to Slobodan Drvenica, Information & Analysis Manager at Windsor Brokers, “Positive signals are also developing on a weekly chart, as the pair is on track for the third consecutive bullish weekly close with further bullish signal seen on close above weekly 10SMA (1.1620). Extended consolidation is expected to be likely scenario as bulls look for a catalyst to continue higher.”

“However, the deeper pullback cannot be ruled out as negative signals are developing, with bull-cross of 10/55SMA’s offering solid support at 1.1620 zone and guarding pivotal support at 1.1568 (Fibo 38.2% of 1.1300/1.1733 rally) Res: 1.1690; 1.1718; 1.1733; 1.1750. Sup: 1.1641; 1.1620; 1.1568; 1.1542,” Slobodan adds.

Key Notes

About Eurozone flash CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

Comments

Post a Comment