OIL FIRMS AHEAD OF ALGIERS OPEC MEETING THAT MAY SET STAGE FOR Q4

Fundamental Forecast for <USOIL>: Bullish

FUNDAMENTAL CRUDE OIL PRICE TALKING POINTS:

- The ONE Thing: The OPEC meeting with allies in Algiers is expected to focus on production gains as Iranian sanctions and depletion rates in Venezuela look to force the hand of OPEC. Reuters reported on Friday that the likely increase would be around 500k barrels per day.

- The correlation between WTI and Brent crude contracts have fallen to the lowest since 2014 as supply pressure in Brent regions and perceived oversupply in WTI from US E&P cause the market to diverge in favor of Brent.

- Per BHI, U.S. total rig count falls 2 to 1053; US Oil rigs fall by 1 to 866

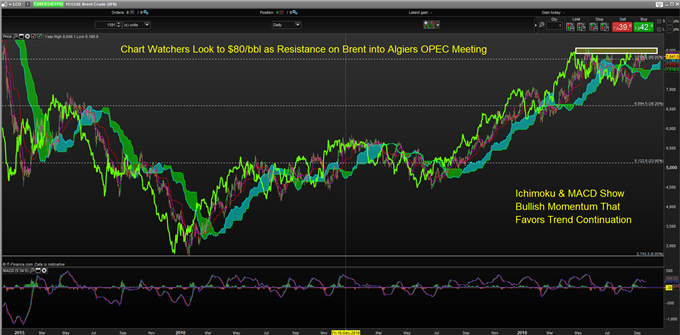

- The technical picture for Brent has a keen focus on $80/bbl. A breakout above this level would align with the technically bullish momentum backdrop seen through Ichimoku and MACD. Such a breakout could see a new range in Brent toward $80-$90/bbl.

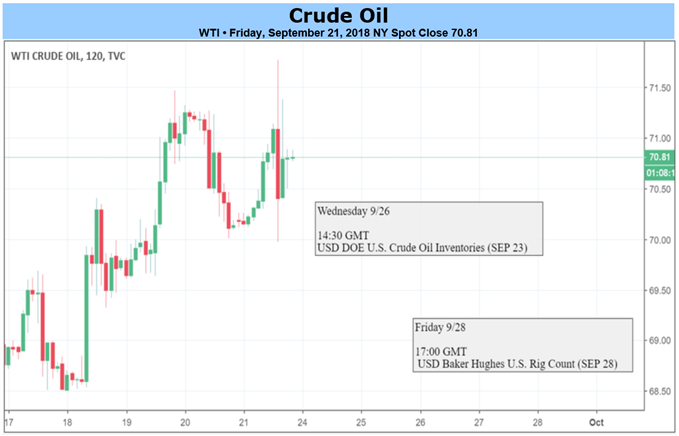

Crude has benefited mightily from a combination of fears surrounding supply shortages on OPEC-member depletion rates and sanctions as global economic growth continues to hum. Wednesday’s EIA Crude Oil Inventory Report was read as bullish as both gasoline and crude inventories saw a draw, which led to a sharp rise in the front-month crude oil contract.

Some traders are focusing on the divergence between WTI and Brent, which is beginning to smell like 2011 when the WTI-Brent spread blew out as the correlation between the two benchmarks fell to the lowest level since 2014 on a 120-day rolling scale. The breakdown in correlation is seen as the supply risks are tilted toward Brent whereas WTI is being by demand keeping up with shale production.

As OPEC is set to meet this weekend, traders are anticipating a likely boost in production with a possible 500k barrel per day increase per Reuters to counter the Iranian sanctions imposed by the US. The bullish outcome scenario that traders should watch for is whether OPEC and allies feel they cannot immediately cover the lost output from Iran as well as Venezuela’s depletion rates.

Leading up to the meeting, Iran has argued that an increase in production in response to their sanctions is a violation of the OPEC agreement. However, it appears the wind is blowing to favor a production increase as Russia and Saudi likely appease Trump’s request to “get prices down now!”

BRENT OVERTAKING $80/BBL COULD LEAD TO HIGHER RANGE OF $80-$90/BBL

Start Trading with Free $30 : CLAIM NOW $30

VERIFY YOUR ACCOUNT AND GET YOUR $30 INSTANTLY ,MAKE MONEY WITHDRAW !!

IF YOU FACE ANY PROBLEM TO GET THIS OFFER PLEASE CONTACT US FOR

SUPPORT , CLICK SMS BAR ABOVE THEN TALK TO US.

Comments

Post a Comment